hpo economic commentary, 3rd quarter 2023

Will the soft landing succeed?

The gap in economic development continues to widen. While the United States is reporting robust and recently even rising GDP growth figures quarter after quarter, the economies in Europe and China are weakening.

Share article

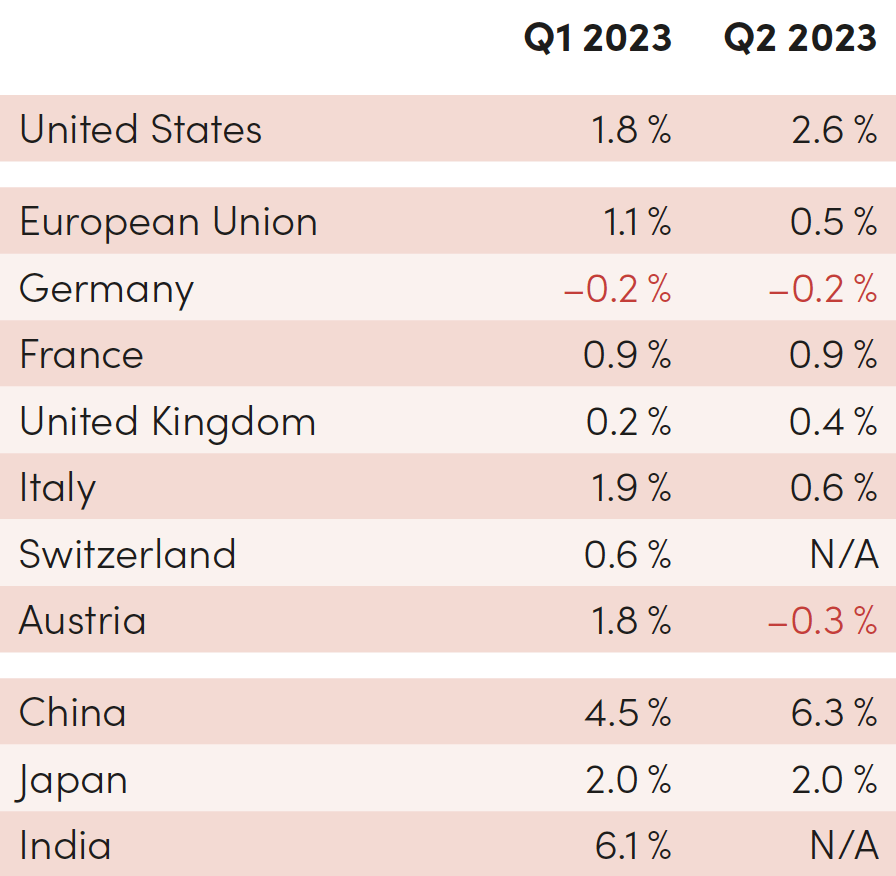

In the last two quarters, the US economy grew significantly faster than the Euro zone. Germany in particular, with its important industry, is currently showing a glaring weakness in growth.

Tab. 1: Real GDP growth figures per year for selected countries

Sources: Trading Economics

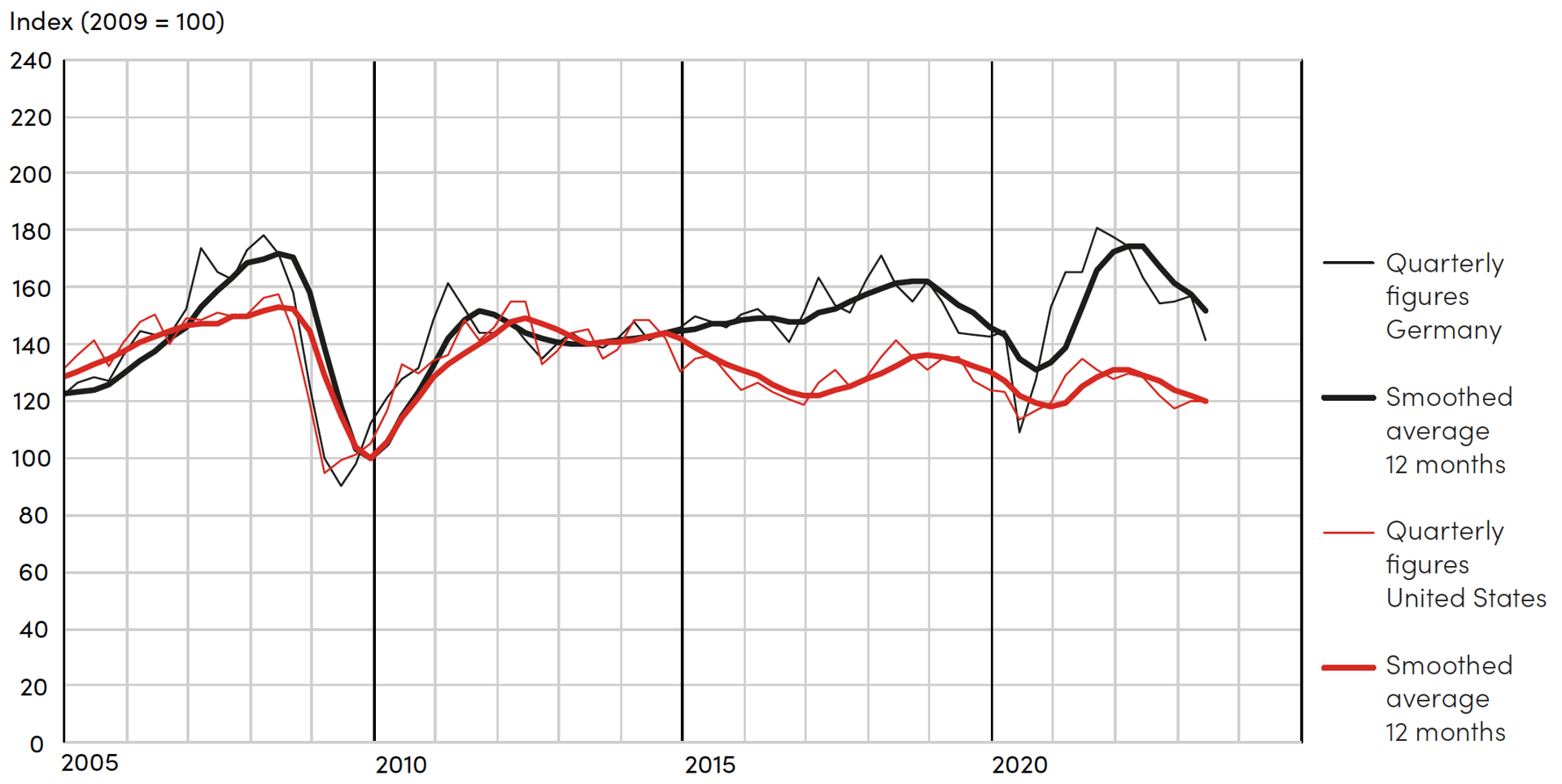

In the machinery sector the trend is more homogeneous. In the United States, Germany and Japan, inflation-adjusted order intake for machinery construction, measured on a 12-month moving average, peaked in the course of 2022. Only nominal values still rose marginally in the United States in the first half of 2023. In Germany, order intake fell by 5.8 % in nominal terms and by 12.8 % adjusted for inflation in the past four quarters, according to Destatis. The drop in sales has so far been rather small, as many mechanical engineering companies were able to draw on the high order backlogs at the beginning of the year, but these are being increasingly reduced. According to the VDMA, for example, the order backlog in the German mechanical engineering sector fell by 10 % year-on-year in nominal terms in July.

Fig. 1: Inflation-adjusted order intake mechanical engineering Germany and United States

Sources: Data by Destatis, CENSUS, BLS; illustration by hpo forecasting

Germany with the red lantern in the G7

Shortly before the turn of the millennium, The Economist referred to Germany as The Sick Man of Europe in a widely read article. Shortly thereafter, under Chancellor Schröder, Germany succeeded in launching a series of economic policy reforms, above all in the labour market.These had an impact, and around ten years later the country presented itself as the growth engine of the EU.

If the numerous market comments and assessments by industry representatives are to be believed, Germany is once again at a point similar to that of the late 1990s. Important reforms have been postponed for too long over the past two decades. Reasons for the current weakness in growth include a reform backlog and bureaucracy, high energy costs (phase-out of nuclear and coal-fired power and simultaneous elimination of cheap Russian gas), the shortage of skilled workers, and weak growth in the important export market of China. In addition, the German automotive industry has fallen behind Tesla and its Chinese competitors in the future market of electric mobility. VW was recently ousted by BYD from the top spot of car sellers in China.

In the Country Index Family Businesses, the country most recently slipped from 9th place in 2014 to 18th out of a total of 21 countries classified. Neighbouring Switzerland and Austria also came under pressure in this ranking, still occupying 4th and 13th place respectively. Economic conditions are assessed in the categories of taxes, financing, labour, infrastructure, regulation and energy. In the categories taxes (rank 20), labor (19), regulation (19) and energy (18), Germany is at the bottom of the rankings.

Figure 2: Country Index Ranking Family Businesses

Source: Family Business Foundation

Germany currently has the lowest GDP growth figures of the G7 countries. At the same time, it must be borne in mind that the share of GDP accounted for by industry in Germany, at around 30 %, is much higher than in the other G7 countries, where the figure is around 20 % in each case. If global industry weakens, Germany will be much more affected than other OECD countries, where the service sector is more important. However, a stagnating Germany slows down the entire EU.

Economic growth in Germany is thus held back by structural as well as cyclical factors. Politicians are called upon to improve the structural framework conditions, and this also applies to Switzerland, Austria and many other European countries. However, the cyclical factors should be controlled by the companies themselves, at best by adjusting the business model.

Despite the stagnating economy, unemployment in Germany remained at a low 5.6 % in June and the labour force participation rate was 79.8 % in the final quarter of 2022, the highest level since the data series began some 25 years ago. The figure was also still 79.7 % in Q1 2023. 29 % of the workforce work part-time, a high figure in Europe, exceeded only by the Netherlands, Austria and Switzerland.

Will the soft landing in the United States actually succeed?

For months now, a bitter debate has been raging in the business press as to whether the United States will succeed in achieving a soft landing after the sharpest interest rate hikes in more than 20 years. Historically, this would be a very unusual event. In past decades, a sharp increase in key interest rates was always followed by a recession.

The bulls base their positive assessment of the situation on the following arguments: Although the Fed raised key interest rates by 5 % within 18 months, a recession has so far failed to materialise and the labour market in particular is proving extremely robust (unemployment rate of 3.5 % in July).

Real consumer spending in the United States continues to rise. In Q2 2023, for example, spending on consumer durables was back at 130 % of its pre-pandemic 2019 level. Meanwhile, demand for services is also 5 % above its 2019 level, and that for nondurables is 11 % higher. Overall consumer spending is up 9 % in real terms since the end of 2019. By comparison, in the EU, according to Eurostat, real seasonally adjusted consumption in Q1 2023 was at the same level as in Q4 2019 and consumption patterns have largely normalised, as expected.

Fig. 3: Development of real consumer spending in the United States

Source: Raw data by Bureau of Economic Analysis, illustration by hpo forecasting

Despite the restrictive monetary policy, the U.S. government’s fiscal policy remains very expansionary. In the Corona year, the federal budget deficit was 14.9 % of GDP.

This fell to 11.9 % in 2021 and was still a high 5.4 % of GDP in 2022. Good economic growth in the United States is driven to a not insignificant extent by high government spending, and the extent of the expansion of the government share in peacetime is unprecedented in America.

Even though the tone has changed under President Biden, the substance of economic policy is hardly different from that of President Trump. “America First” applies under Biden as well. The increasing rejection of free trade, the political and economic containment of China, and the promotion of domestic industry are the cornerstones of his economic policy. With the Infrastructure and Jobs Act, the Chips and Science Act and the Inflation Reduction Act, Biden is pursuing a dirigiste industrial policy that fundamentally contradicts the rules of the WTO. This increasing distancing from free global trade will diminish world prosperity and unleash a costly global subsidy spiral. But, at least for the time being, American industry is benefiting massively, as the numerous investment announcements in the United States suggest.

Since inflation peaked at 9.1 % in June 2022, it has fallen again surprisingly quickly to 3.2 % by July 2023. An important factor in both the rise and the fall was volatile energy prices. For example, energy prices fell by 12.5 % y/y in July, while core inflation (inflation excluding volatile energy and food prices) remained high at 4.7 %. The rapid decline in inflation rates is fueling hopes of an approaching end to the Fed’s interest rate hike cycle, which in turn has buoyed the financial markets since the beginning of the year.

In the discussion surrounding monetary policy, it should not be forgotten that real interest rates have only been moving slightly into positive territory since March of this year. In the Euro zone and Switzerland, real interest rates are still negative which means that inflation was higher than nominal interest rates in each case. This monetary policy can hardly be described as truly restrictive.

Fig. 4: Real Interest rates in the United States, the Euro zone and Switzerland

Source: raw data by S&P Global, illustration by hpo forecasting

The U.S. central bank balance is also still around twice as high as it was shortly before the pandemic. Through the extension of the central bank balance sheet alone, the U.S. economy benefits from increased liquidity in the amount of around USD 4 trillion compared to 2019. This difference is roughly equivalent to the GDP of Germany.

Overall, the economic figures for the United States are actually significantly better than expected a year ago, even if some of this is being bought with very high government spending. When crises surface, they are tackled quickly and decisively with a lot of money, such as the regional banking crisis in the spring.

The bears also have convincing arguments

There are also weighty arguments in favour of the United States descending into recession in the coming quarters after all:

The central point is that key rate hikes only have an impact on the real economy with a lag of 12 to 24 months. In the past, the recession often occurred only after the Fed had already started to cut key rates again. The first rate hike in the current cycle took place around 18 months ago, and so far it is still unclear whether another rate hike will follow in September. So we are still far from seeing the full extent of the consequences of the rate hikes.

For the following reasons, it will take longer in the current cycle than in other periods for interest rate hikes to have a full impact on the real economy. First, the financial situation of households and companies was greatly improved with the stimulus measures during the pandemic and they thus have larger financial buffers. Whereas private debt has risen sharply in recent quarters. Secondly, many players have taken advantage of the low interest rate phase to sign long-term agreements for mortgages and investment loans. This partially immunises these players from the effects of key interest rate increases. If mortgages are fixed at a low rate and interest rates on money market bonds, which are popular in America, rise, many players actually benefit financially from the key interest rate hikes because their debts bear lower interest rates than their balances.

The hpo forecast model, which relies heavily on real economic indicators such as consumption, industrial production and sentiment indicators, also indicates a recession for the United States in 2024. Whether this will actually occur also depends on whether the Fed gives greater weight in the future to the goal of full employment or to containing inflation. So far, inflation control has been comparatively easy, as the economy has still been robust. It remains to be seen whether the Fed will stand firm in the event of stronger skid marks in the economy. Despite better than expected development, the risk of recession has not been banished.

China continues to disappoint

While the economic development in the United States is a positive surprise, the opposite is the case in China. The real estate crisis continues to smolder. In mid-August, the large real estate developer Country Garden caused a stir because it was unable to service part of its debt interest. If the group cannot service the bonds within 30 days, it faces insolvency. The company has USD 194 billion in outstanding debt. It can be assumed that the Chinese government will offer a solution in this case as well, but the example illustrates the precarious situation in which the Chinese real estate sector continues to find itself.

Youth unemployment reached a new record level of 21.3 % in July. The Caixin Manufacturing PMI fell again into contractionary territory in April. Exports, which are responsible for about 20 % of China’s GDP, fell 14.5 % year-on-year in July, hitting a five-month low. Direct investment in China plunged from USD 100 billion to USD 20 billion in Q1 2023 compared to Q1 2022, according to consulting firm Rhodium.

Nevertheless, the economy grew by 6.3 % year-on-year in the second quarter. However, this must be put into perspective, because a year ago important economic centers such as Shanghai were in a hard lockdown, and the basis for comparison is correspondingly low. Many economists doubt whether the targeted economic growth of 5 % can be achieved. Numerous hpo customers also report a very challenging market environment in the Middle Kingdom.

While Europe is struggling with stagflation (high inflation in a stagnating economy), China is threatened by deflation with a stagnating economy. To get back on a sustainable growth path, consumption would have to be strongly stimulated. But the central government seems unwilling to do this, and the beleaguered regional governments lack the money to do so.

Rather the opposite can be observed. In recent months, there have been increasing reports of regional governments cutting the wages of civil servants by up to 25 %.

Order intake figures in industry will continue to decline

In summary, order intake in industry will continue to decline for the time being. The low values of the purchasing managers’ index for the manufacturing sector speak a clear language. In the short term, growth impetus is most likely to come from the United States.

Very early-cycle sectors such as the textile machinery and semiconductor industries, which each react very quickly and strongly to economic changes, have already been recording sharply falling order intake figures since the beginning of 2022. The last two quarterly figures give rise to hopes in these segments that the bottom has now been reached. In most other industry segments, it is likely to be some time before this phase is reached.

![]()

Fig. 5: Semiconductor shipments worldwide

Source: raw data by SIA, illustration by hpo forecasting