hpo economic commentary, 3rd quarter 2024

Are the United States, the most important pillar of global economic growth, wobbling?

The most important facts

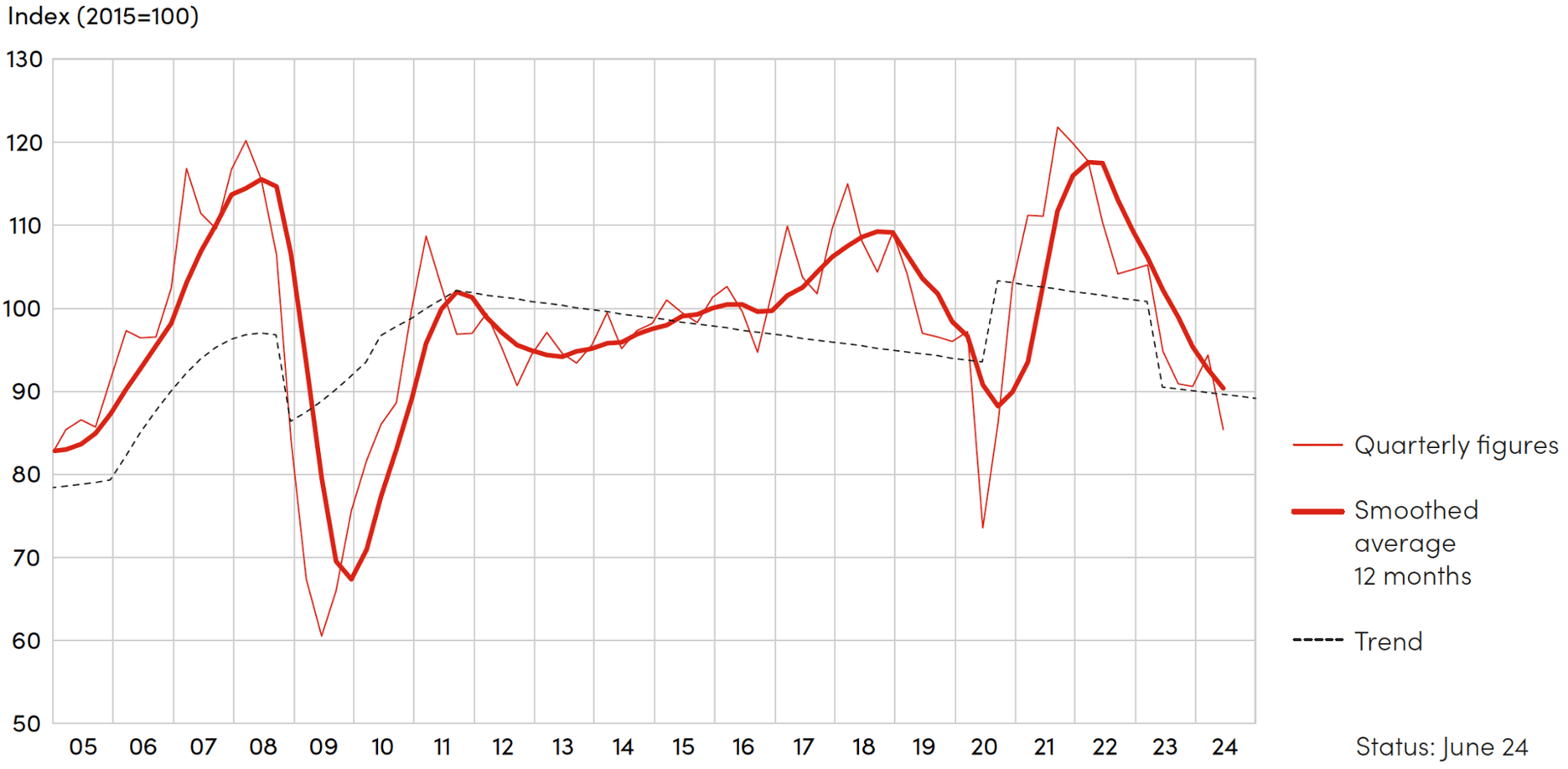

- Following temporary stabilisation, real incoming orders in the German mechanical engineering sector fell again significantly in the 2nd quarter of 2024. Since the peak at the beginning of 2022, the 12-month moving average has fallen by 23 %.

- The important automotive industry is also stagnating in Germany. In real terms, the smoothed order intake is roughly at the level of 2010 and 2020, when the financial crisis and coronavirus were running rampant. New car registrations in the United States have also been stagnating for around a year. It has already levelled off again at a low level in Europe.

- American consumption has been the most important pillar of the global economy in recent years. Three different US recession indicators, which have proven to be very reliable time and again over the past few decades, have turned red.

- However, the vast majority of economists continue to expect a soft landing for the US economy. However, there is a broad consensus that the United States are facing a period of lower economic growth.

- The Chinese Party’s latest decisions on the economic policy direction for the next five years continue to prioritise ideology and securing the Party’s power over economic prosperity. There is a lack of urgently needed measures to boost Chinese consumption. China’s growth rates will therefore continue to fall.

Below you will find the detailed version of the hpo Economic Commentary for the 3rd quarter of 2024.

Share article

Hopes of the mechanical engineering sector bottoming out were shattered

Until the first quarter of 2024, real incoming orders in the mechanical engineering sector in Germany moved sideways for around a year after a sharp decline since 2021. In the first quarter, the quarter-on-quarter figure even rose significantly for the first time in over two years (+4 % according to the German statistics office Destatis). This fuelled confidence in many places that the trough of weak demand had been reached. This hope has now been shattered: In the second quarter, real incoming orders fell by around 10 % in a quarter-on-quarter and year-on-year comparison. The 12-month moving average thus continues to fall unabated (–12 % year-on-year and –23 % since the last peak in the first quarter of 2022).

The German Mechanical Engineering Association(VDMA) has also become more pessimistic again in its assessment. It wrote in its media release at the beginning of August that there are no signs of a turnaround in incoming orders.

Even with the new economic data, hpo’s forecast remains stable and, as before, we do not expect a turnaround in the general mechanical engineering sector this year. The situation in individual sub-segments can naturally deviate significantly from this dynamic.

Apart from the periods during the financial crisis and the peak of the pandemic, inflation-adjusted order intake in the German mechanical engineering sector has never been this low since 2006. This is not only due to the current economic weakness, but also to the long-term trend growth, which, apart from the 2021/2022 bubble, has remained constant at –1 % per year since 2012. Due to the strengthening and increasing international competition from China, the trend will hardly increase in the coming years.

Fig. 1: Real order intake in mechanical engineering in Germany

Source: Raw data by Destatis, illustration and trend calculation by hpo forecasting

The situation in the automotive sector, which is so important for the German industry, also speaks in favour of this development, as automotive production is stagnating. Measured on a 12-month moving average, the inflation-adjusted order intake in Germany is back at the low level of 2010 (financial crisis) or 2020 (pandemic). The number of new registrations of passenger cars and light trucks in the United States has not been growing for around a year and, as expected, new registrations in Europe have already levelled off again at a low level after a rather weak recovery phase. The values in both regions are similarly low to 2014 and are 17 % below the last interim high of 2018 in Europe (United States: –10 % since 2018). In China, foreign suppliers are coming under increasing pressure from domestic competitors.

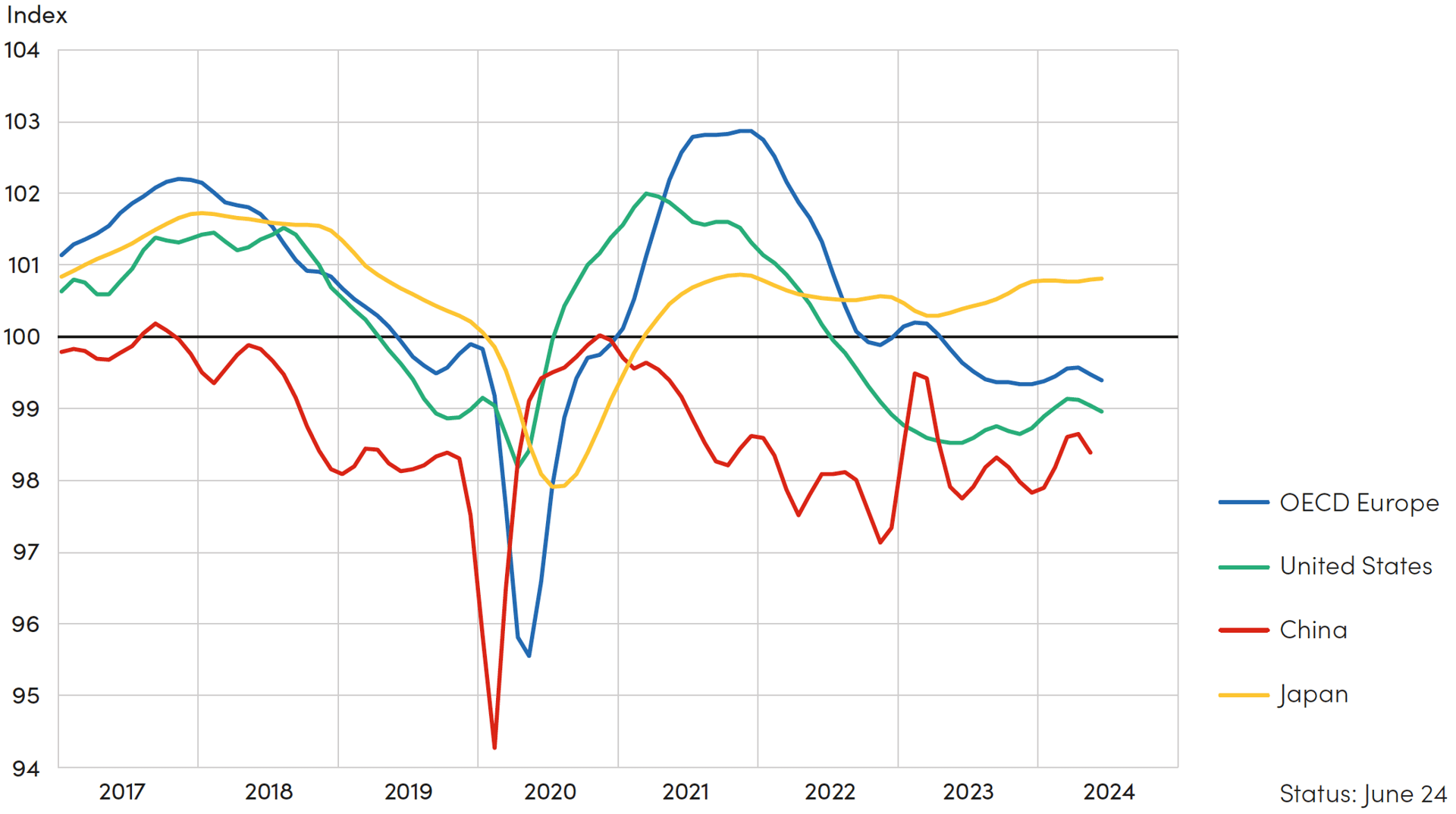

Following a temporary recovery at the start of the year, the OECD’s Business Confidence Index (BCI) is once again showing signs of weakness, moving deeper into contractionary territory in Europe, the United States, and China. The BCI is a good early indicator for the capital goods industry.

Fig. 2: Business Confidence Index (BCI)

Source: Raw data by OECD, illustration by hpo forecasting

According to the OECD, consumer sentiment in the United States, Japan, and China has also sank deeper into pessimistic territory. Only in Europe did the recovery continue, but the value remains below the neutral level of 100.

The high level of US government and consumer spending is supporting global economic growth

With over 25 % of global gross domestic product (GDP), the United States continue to lead the way for the global economy. Thanks to continued strong economic growth in recent years (annualised 2.8 % in 2nd quarter 2024), the country is the main pillar of the global economy, while the two major economies of China and the EU grew below their potential. Economic growth in the United States is crucial globally, but darker clouds have increasingly appeared on the horizon in recent weeks.

Growth rates in the United States have remained at a surprisingly high level since the pandemic. The main reasons for this were the government’s extremely high public spending on the one hand and Americans’ lively consumption on the other. Two figures that illustrate this are the dizzyingly high government deficit of 6.2 % of GDP last year and the extremely low savings rate of American households of currently 3.4 %.

According to current information, the US government deficit will remain high, regardless of who wins the elections in November. This may become a problem in the long term, but is supporting growth for the time being. There are bigger question marks over private consumption, and the unemployment rate also plays an important role here.

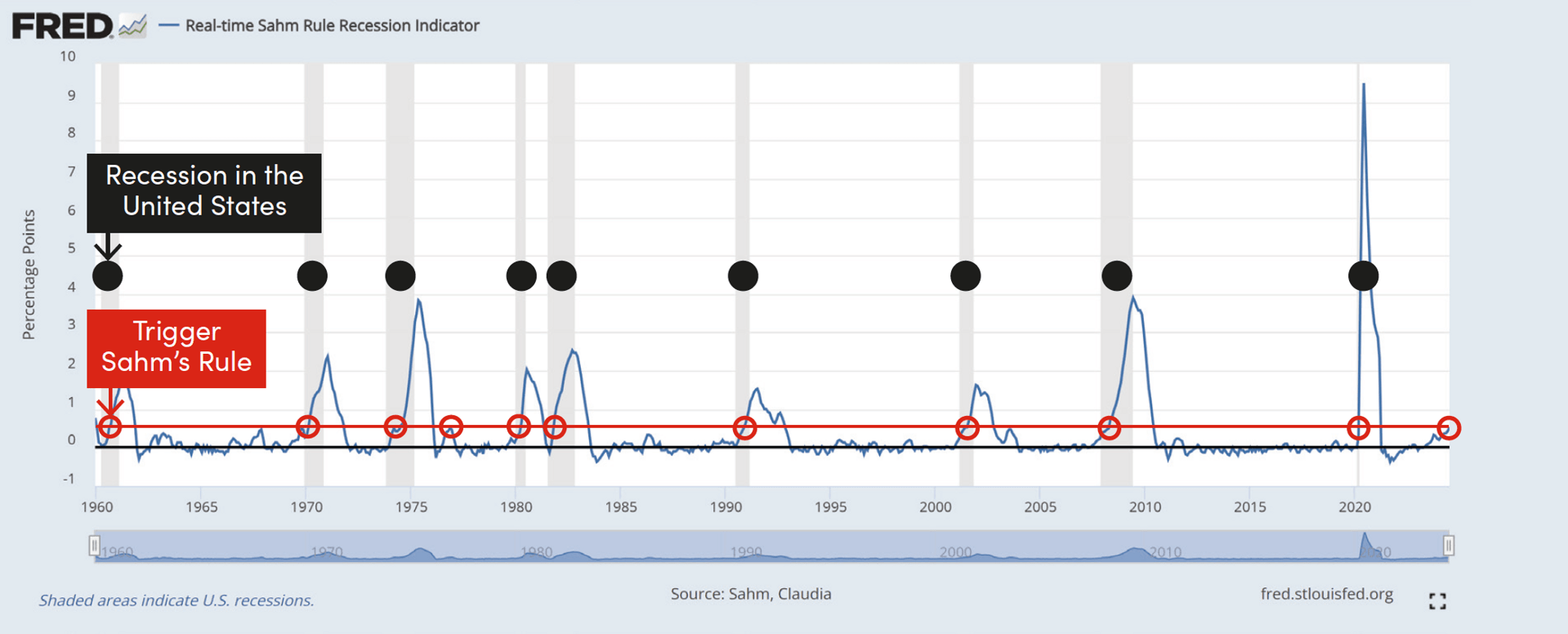

Three recession indicators are lighting up

The surprisingly sharp rise in the US unemployment rate from 4.1 % to 4.3 % in July was one of the triggers for the turbulence on the stock markets at the beginning of August. This caused the much-observed Sahm Recession Indicator to light up. In the past, this indicator has always signalled the start of a recession when the three-month moving average of the national unemployment rate rises by 0.5 percentage points or more compared to the minimum of the three-month averages of the previous 12 months. Since 1950, this indicator has correctly signalled every recession shortly before or in the initial phase of a recession. During this phase, there was only one false indication, when the indicator lit up in 1976 and fell again shortly afterwards, without a recession immediately following. This makes the Sahm Recession Indicator an extremely accurate instrument.

Fig. 3: Sahm Recession Indicator

Source: Federal Reserve St. Louis, retrieved on 13 August 2024

At this point, it should be noted that the unemployment rate in July is considered distorted by various parties, as many new job seekers flooded the market due to the high level of migration and the end of the school year. In addition, Texas was hit by Hurricane Beryl in July and many employees on temporary contracts were laid off for a short time.

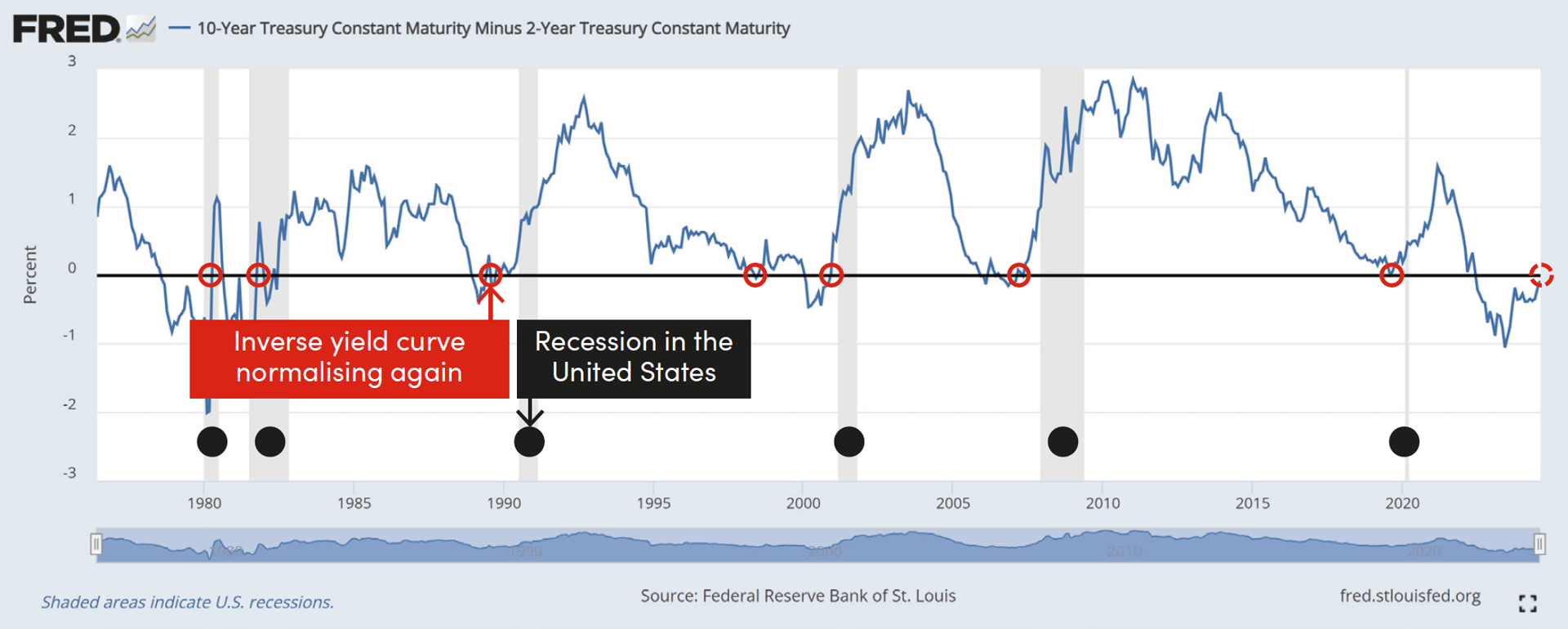

Another reliable recession indicator is the difference between the interest rates paid on US government bonds with a term of ten years and two years. Since the beginning of the data series in 1976, every recession in the United States has been preceded by a phase in which long-term government bonds paid lower interest rates than short-term government bonds. This anomaly is known as an inverted yield curve. However, the time that elapsed between the first occurrence of the inverted yield curve and the recession varied greatly in the past, fluctuating between a few months and around two years. Before a recession occurs, however, the yield curve normalises again, and a recession follows shortly afterwards.

Since 2022, the yield curve has been inverted for an unusually long time. With the expectation of falling prime rates from September, the yield on short-term government bonds has fallen rapidly since May, and interest rates have converged sharply. At the time of writing on 13 August, the yield curve was still slightly inverted. But if the current trend continues, it will quickly normalise. If the pattern of the past repeats itself, a recession in the United States will soon become a reality. In the past, this established recession indicator has only been falsely triggered once (in 1998).

Fig. 4: Development of the interest rate differential between 10-year and 2-year government bonds

Source: Federal Reserve St. Louis, retrieved on 13 August 2024

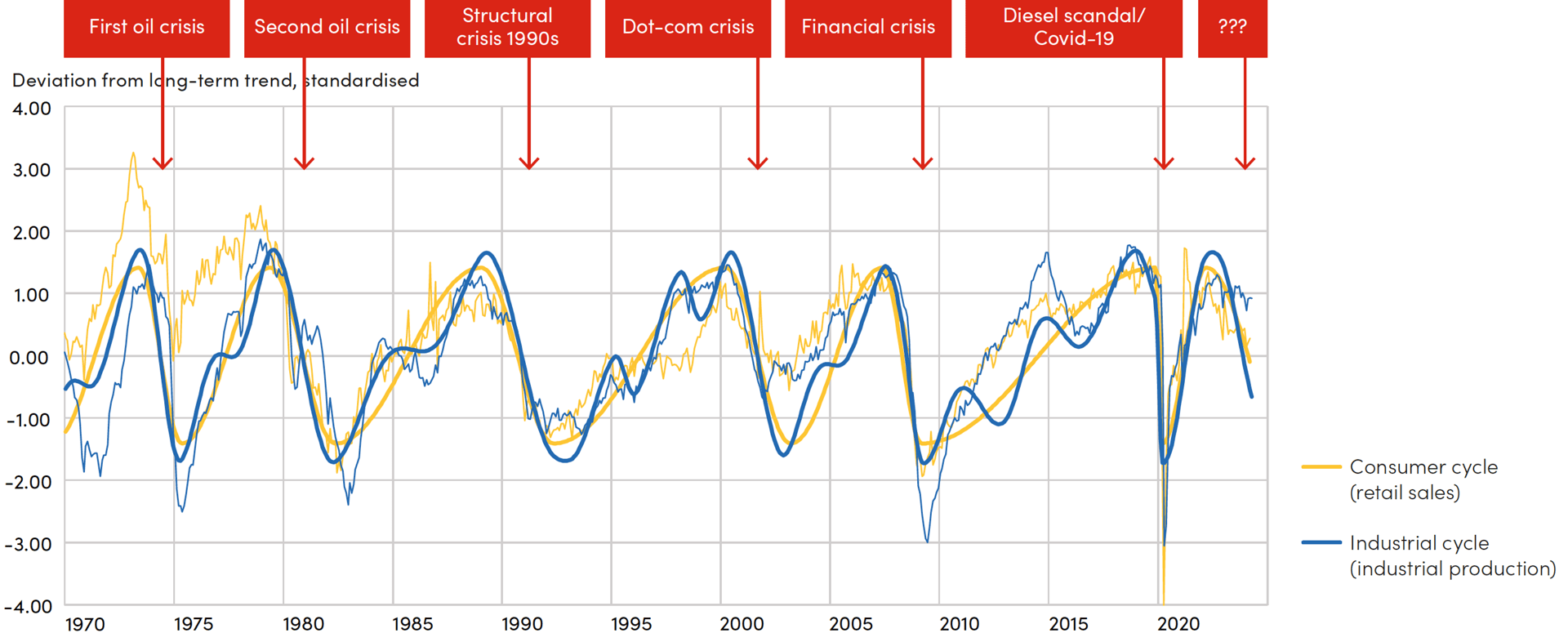

The hpo analysis of consumer and industrial cycles shown in figure 5 also points to a recession in the United States. The consumer cycle is represented by the deviation of retail sales from the long-term trend, and the industrial cycle is the deviation of industrial production from the long-term trend. Industrial production oscillates around consumption, the long-term driver of the real economy. In the past, the United States always fell into recession after the consumer cycle had reached a temporary peak. This constellation always triggered an unstable phase in the economy. A possibly relatively minor event was the straw that broke the camel’s back and led to a crisis. This model can be used to explain all major economic crises since the 1970s.

Fig. 5: Industrial and consumer cycles in the United States

Source: Raw data by OECD; model, calculation, and illustration by hpo forecasting

The pandemic and the associated massive stimulus measures, as well as the shift in consumer preference towards durable consumer goods, led to a very short and violent cycle, which peaked again in 2022 after 2019. Since then, the real economy has been in an unstable phase again, which is typically accompanied by a sharp decline in incoming orders in the capital goods industry, which can also be observed this time. In such unstable phases, bubbles often burst on the financial markets. However, the crises can have varying degrees of impact on the real economy. The 2008 financial crisis was extremely severe, with both industrial production and consumption suffering considerable losses. In contrast, the dot-com crisis was primarily a crisis on the financial markets, which affected the manufacturing economy to a lesser extent.

For around two years, cyclical analyses have indicated a sharp economic slowdown in both the United States and Europe. While Europe has essentially followed the script, the US economy has so far proved to be more resilient than expected. However, the danger has not yet been averted. The economy is still in an unstable phase, which means that any trigger could lead not only to a slowdown in growth but also to a recession.

Current fundamentals favour an economic slowdown rather than a recession

The three US recession indicators described above are somewhat relativised by the current actual data.

- The unemployment rate is still extremely low by historical standards.

- Despite a slight correction in recent quarters, retail sales are still around 10 % above the 2019 level in real terms, which was already the peak of a boom phase at the time.

- Despite stagnation, US industrial production is also still quite stable at a high level. It continues to surprise positively in this environment.

These observations are fuelling hopes that the recession indicators described above could be wrong this time and that the United States are only experiencing an economic slowdown and not a recession.

Reading the business press and market commentary, it is striking that the majority of economists currently expect a slowdown in growth, but not a recession, in the United States. For example, the Philadelphia Fed surveys around 100 leading macroeconomists every quarter on their expectations for GDP growth in the United States. In the latest survey published on 9 August, the median forecast for US economic growth is 2.4 % and 1.9 % for 2025. The risk of negative economic growth in one of the quarters of 2025 is put at around 25 %. The median forecast for unemployment will not rise above 4.3 % in 2025 as a whole and will remain at the current level according to this estimate.

However, this is little consolation for the mechanical engineering industry, as inflation-adjusted demand for machinery in America has also fallen by over 10 % since the beginning of 2022 and the hpo forecasting model indicates a further decline of around 8 % for 2024. In the event of a deep recession in the United States, the expected setback would be even more pronounced.

No news from the Middle Kingdom

After the detailed report on the US economy, let’s take a look at the Far East. China’s economic growth weakened in the second quarter and, at 4.7 %, was below the Communist Party’s target of 5 % and below the long-term trend.

In July, the Central Committee of the Communist Party of China met for its Third Plenum, at which the economic policy for the next five years is approved. “Expectations for last week’s Plenum were low – and they were undercut,” wrote the renowned online magazine The Market/NZZ in its report. Despite enormous overcapacity, the Party is focussing on further strengthening domestic industry and strong exports. For sustainable economic growth, domestic consumption should be given much greater weight, but overdue measures to strengthen it still do not seem to be a priority for the Chinese government.

Zuongjuan Zoe Liu, Senior Fellow for China Studies at the Council on Foreign Affairs, does not see this as the Party’s economic inability, but rather its unconditional claim to power. In her article from 6 August 2024 in the journal Foreign Affairs, she aptly writes that it is clear that the Chinese economy needs to find a new balance between investment and consumption.

But it is unlikely that Beijing will make this shift because it is dependent on the political control it gains through a production-intensive economic policy. For better or worse, the bloated and marginally profitable Chinese industrial sector is dependent on favourable financing from state banks and regional governments. This means that industry is directly dependent on the state and the Party has great power over the sector. “In the Party’s view, consumption is an individualistic distraction that threatens to divert resources from China’s core economic strength: its industrial base,” writes Liu. This neglects the fact that the economy is now too big for a one-sided export-orientated growth model.

Most commentators agree that the ideological and power-orientated focus of Chinese politics will not change in the coming years. This means that no strong growth impetus can be expected from China for the time being. And low growth figures are also emerging for Europe and the United States. This means that there is currently a lack of economic impetus for a strong upturn in the mechanical engineering sector.