hpo economic commentary, 4th quarter 2024

What are the consequences of the US elections for European industry?

The most important facts

- The political framework is changing rapidly at the moment:

- Europe has been weakened by the government crises in Germany and France.

- China is supporting its local governments financially, but the stimulus package is falling far short of expectations.

- The Republican Party wins the presidency and a majority in both chambers of parliament in the United States.

- The high US economic growth is being bought with an excessive budget deficit. If Germany were to pile up debt just as unrestrainedly, it would also have higher growth in the short term.

- The economic policy postulated in the election campaign will hardly be fully realisable under Trump. The four central pillars, such as lowering corporate taxes, increasing tariffs, deregulating the economy, and reducing migration, will boost both economic growth and inflation, even if they are only implemented in part.

- The attempt to re-industrialise America offers opportunities for European mechanical engineering companies.

- In hpo’s brief survey of over 80 decision-makers in the metalworking industry, more than half reported weak or very weak demand in their own companies and only a quarter believe that the situation will improve in the next six months.

- According to hpo model calculations, incoming orders have bottomed out in many segments of the capital goods industry.

Below you will find the detailed version of the hpo Economic Commentary for the 4th quarter of 2024.

Share article

The political environment is changing rapidly

Many of you know our conviction: The short and medium-term consequences of political decisions on the real economy are greatly overestimated in most cases. For this reason, we at hpo forecasting focus our analyses on fundamental macroeconomic and sector-specific indicators. We tend to treat the influence of politics as secondary, as this is difficult to predict, and much of what is hyped up in the short term later turns out to be a storm in a teacup. However, there are moments when fundamental decisions are made that even we cannot ignore. The beginning of November was such a moment.

In the United States, Trump surprisingly won the majority of the votes in all swing states. The Republican Party also won the majority in the Senate and the House of Representatives. This gives the President a great deal of power and the opportunity to change laws, largely bypassing the Democrats, even if the majorities in the two chambers of parliament are only narrow.

In Germany, the traffic light coalition has collapsed. In view of the rapidly changing balance of power overseas, a united and effective government in Europe’s largest economy would be highly desirable. A strong and stable political leadership in Germany that knows how to assert itself in a tougher international environment and is taken seriously is in the interests of the whole of Europe including Switzerland. This is particularly true as France, the second largest economy in the EU, is also governed by a minority government. This government is currently having the greatest difficulties just getting a budget for 2025 through parliament.

In China, the government announced on 8 November that it intends to use USD 1.4 trillion to refinance highly indebted local governments. This is urgent because, according to estimates, they are sitting on a mountain of debt totaling USD 13 trillion and, in many cases, are close to insolvency. This huge aid package can prevent major damage to the economy. However, it does not have the qualities of a stimulus package. It is a far cry from the measures that were expected in advance and partly publicised in the state media.

The government has yet to provide details of the stimulus package announced to boost weak consumption. It is well known that President Xi Jinping is fundamentally sceptical about such stimulus measures. Without a stimulus package, economic growth in China is likely to remain subdued by local standards.

US economic growth at the price of high debt

We look at the robust economic growth of recent years in the United States with a mixture of envy and admiration. While gross domestic product (GDP) growth in the eurozone is expected to be around 0.8 percent this year, according to the latest estimates from the International Monetary Fund (IMF), the IMF is forecasting a growth rate for the United States that is more than three times higher.

Even if the American technology sector is in enviable shape, the high economic growth is being bought with a high national deficit. The same applies to China with its 4.8 percent growth. This is shown by the following simple calculation using the United States as an example: GDP growth is expected to be 2.8 percent in 2024. At the same time, however, the IMF also expects the government to run a budget deficit (cumulative for all levels of government) of an extremely high 7.1 percent of GDP. A key driver of this new debt is the Inflation Reduction Act and other measures with which the Biden administration is massively promoting domestic industry. This means that a lot of money is being pumped into the economy at the expense of future generations. In this respect, it is logical and politically desirable for the economy to grow. If you add the GDP growth rate to the negative budget balance, you get an approximation of economic growth if the government were to report a balanced budget. In this case, the US economy would shrink by 4 to 5 percent in 2024 and be mired in a deep recession.

If the eurozone or Germany were to accumulate debt to the same extent and pump the money into their own economies, growth on this side of the Atlantic would also be a few percentage points higher. This beer mat calculation is certainly too simple and in no way claims to be scientifically accurate. However, it is intended to illustrate that we should not be blinded by America’s economic growth and should not talk down the performance of European economies.

Which strategy will ensure stronger growth in the long term will not be discussed in detail here. Debt can drive economic growth in the short term. According to most economic theories, high government debt slows down the long-term growth trend and restricts the room for manoeuvre in future crisis situations. However, things can go well for many years before a debt crisis suddenly threatens. As the issuer of the global reserve currency, the United States has a major advantage in this respect.

Switzerland is (still) in a comfortable position, with both positive economic growth and a small budget surplus, thanks to many years of fiscal discipline, liberal legislation, and the avoidance of expensive, dirigiste, and ineffective economic policies. These achievements must be preserved at all costs.

Fig. 1: GDP growth, budget balance and sum of GDP growth and budget balance of selected countries for 2024

Source: Raw data estimates by IMF, presentation and calculation by hpo forecasting

Trump’s economic policy is contradictory and can be broken down into four central elements

The die has been cast in America. What does Trump’s programme mean for the economy and for the European capital goods industry in particular? In answering this question, we are entering the realm of speculation. No one can know which of his sometimes extreme positions he can and will actually implement.

On the one hand, his economic policy election promises harbour major internal conflicts of objectives; on the other, Trump’s majority in the Senate and House of Representatives is only narrow. In order to get legislative changes through the Senate, he must also win over at least one of the four moderate Republicans who did not support Trump during the election campaign in favour of his concerns out of the 53 Republican senators. Some of the excesses of the election promises may also be seen as bargaining chips for later deals with trade partners.

Nevertheless, at this point we venture an interpretation of the possible impact of economic policy from 2025 onwards. Basically, his announcements can be broken down into four central elements of his economic policy:

- Reduction of corporate taxes from the current 21 percent to 15 percent

- Increase tariffs on China to 60 percent and on all other countries to 10 to 20 percent

- Deregulation of the economy (environment, financial sector and much more)

- Reduction of migration and expulsion of millions of immigrants without valid residence permits

The economic consequences for the United States and the potential impact on European industry are outlined below for these four topics.

Measure 1: Reduction of corporate taxes

According to estimates by Bank of America, the planned reduction in corporate taxes would boost corporate profits by 4 percent and thus presumably spark a stock market fireworks display. We know from the first presidency that the new/old president equates advances on the stock market with his performance curve as president. The higher profits, from which cyclical consumption and industry would benefit disproportionately according to Bank of America estimates, would give companies more room for manoeuvre for investments.

European mechanical engineering companies and suppliers would also benefit from this. In the short term at least, however, the US budget deficit would once again skyrocket.

Measure 2: Increase tariffs

The tariff increases announced during the election campaign would make imported goods massively more expensive and protect domestic industry. This would drive inflation up again. The aim of the trade barriers is to re-industrialise the United States. This would be a huge experiment with an uncertain outcome, as so far there is no example of a mature economy that has re-industrialised. In economic history, the path from an industrialised society to a service society has always been a one-way street.

It is obvious that the European export industry would suffer from customs barriers. However, the expansion of production capacities would also mean massive investment in machinery and equipment. This could trigger a strong boom for European machinery and plant manufacturers. However, there will be increasing incentives and pressure to invest more in America. These investments will come up against a dried-up skilled labour market in America. This will fuel inflation.

A realistic scenario is also that the new government will use the threat of tariffs primarily as a threat to force trading partners to make concessions, for example to buy more goods from the United States or invest more in America.

Measure 3: Deregulation of the economy

A push for deregulation would have negative consequences for the environment, as strict environmental protection has long been a thorn in Trump’s side, as his first presidency showed. The oil industry, for example, would benefit from this. Another sector that would gain would be the financial industry.

Deregulation would fuel economic growth and tend to reduce inflation, as the costs of excessive deregulation would only become apparent later in the form of environmental damage and risks on the financial markets. In turn, European exporters would also benefit from economic growth.

Measure 4: Reduction of migration and expulsion of millions of immigrants

Estimates of people living illegally in the United States are around 3.5 percent of the total population (12 million). According to research by economist and migration expert Michael Clemens from George Mason University, certain industries in the United States are extremely reliant on illegal immigrants. In the agricultural sector, he estimates that around half of all workers do not have legal residence status. Many illegal immigrants also work for low wages in the dairy industry, childcare and elderly care. The deportation of a significant proportion of these workers could quickly lead to supply shortages and would fuel inflation.

Increased surveillance of the US borders is feasible with the appropriate resources. The announced mass repatriation of illegal migrants would be much more difficult to implement and would cause major social upheaval. Clemens has calculated that six percent of all students in the United States have at least one parent without legal residency status, even though the students themselves are American citizens.

Migration measures would primarily have an indirect impact on European exporters through a decline in purchasing power in the United States.

Overall, most economists expect an upturn in US economic growth under the new government, at least in the short term. With tax cuts and deregulation, the positive effects on economic growth are likely to materialise relatively quickly once such laws come into force. The costs in the form of interest on debt and environmental damage will not be felt until later. Commerzbank, for example, has raised its US growth forecast for 2025 from 2.0 percent to 2.3 percent following the election. The bank has not changed its euro growth forecast for 2025. The increased economic growth comes at the price of inflationary pressure and a further sharp rise in the government deficit.

The mood has deteriorated further

The Business Confidence Index (BCI) in the United States fell to 98.5 index points shortly before the October elections, equalling the previous low since the pandemic in March 2023. We expect sentiment in the United States to brighten in November and December, as the majority of business representatives probably supported Trump’s election and the scenario of an unclear election outcome did not materialise.

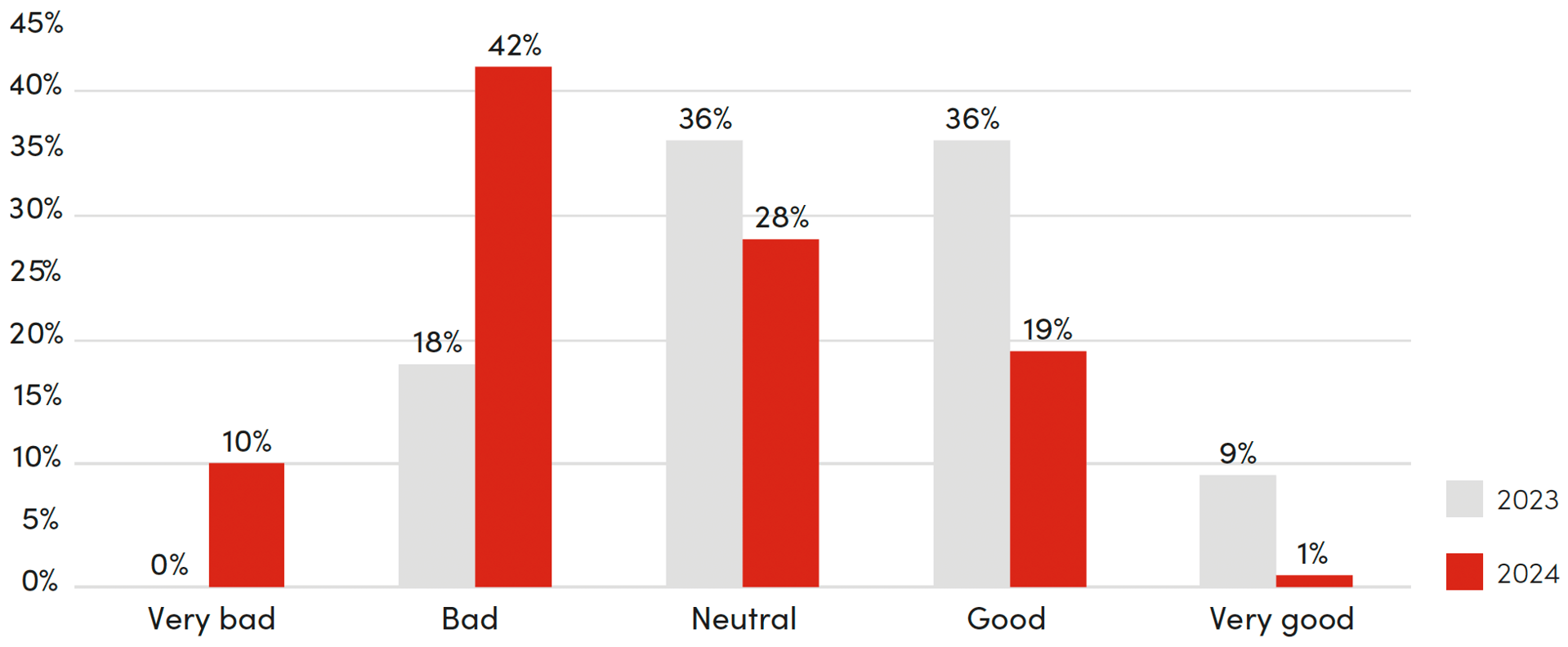

The BCI also continued to fall in Europe, reaching its lowest level since 2020 at 99.2 points. This impression is consistent with the brief survey conducted by hpo forecasting in September and October 2024 at the AMB Stuttgart and EuroBLECH Hannover trade fairs with over 80 decision-makers from the metalworking industry. Over half of the respondents rated the demand situation in their company as bad or very bad. A year earlier, in the survey of the same industry at EMO Hannover 2023, no one described the situation as very bad, and only 18 percent as bad. Currently, only 20 percent of decision-makers rate the order intake in their own company as good or very good.

Fig. 2: Assessment of the demand situation in your own company (“How do you assess the demand situation in your company?”); comparison of the results of the 2023 and 2024 surveys

Source: hpo short survey at AMB Stuttgart and EuroBLECH Hannover 2024, hpo short survey at EMO Hannover 2023

Of those surveyed, only 25 percent believe that incoming orders will improve over the next six months. The vast majority expect a sideways movement during this period and only 18 percent believe that demand will deteriorate further from the current low level.

Respondents are experiencing the strongest demand from the aviation and defence industries. However, the defence sector needs to be put into perspective, as it takes a very long time for orders actually to be triggered due to the dependence on political processes. Demand from the automotive, mechanical engineering and, increasingly, the watch and jewellery industries is currently particularly low.

Many industrial segments are likely to have bottomed out

The market data confirms the poor sentiment, but also shows a levelling off. This supports our model calculation, which indicates that order intake has bottomed out in many segments. While demand from German machine tool manufacturers was 10 percent lower year-on-year, it moved sideways in the most recent quarterly comparison, according to Destatis.

Demand in the very early-cycle textile machinery industry has now been moving sideways for four quarters, as a result of which the 12-month average has also moved sideways. German manufacturers of plastics machinery had to put up with another setback in the third quarter (-11 percent quarter-on-quarter), having previously recorded stable order intake figures for three quarters. Here too, however, the low point has probably been reached.

According to Destatis, the general German mechanical engineering sector also stabilised in the third quarter. The VDMA even reported a quarter-on-quarter increase in orders, but this was primarily driven by individual large-scale plants. The decline measured against the 12-month average is therefore slowly slowing down, but we do not expect this to bottom out until 2025. With the exception of the financial crisis of 2008, we are currently experiencing the deepest crisis since the 1990s.

At present, there is little to suggest that demand in the mechanical engineering sector will increase rapidly and significantly. However, this development can vary greatly between the individual market segments and we do see strong growth figures for some of them in 2025.

Fig. 3: Real incoming orders for mechanical engineering in Germany (12-month averages): Development in the major crises since 1990, in each case starting from the last peak in demand

Source: Raw data by Destatis, calculation and presentation by hpo forecasting